Tips for New Homeowners in Louisiana

Congratulations on becoming a new homeowner in Louisiana! Owning a home is an exciting milestone, but it also comes with responsibilities. To help you settle in and protect your investment, we’ve compiled essential tips specifically for homeowners in the Pelican State.

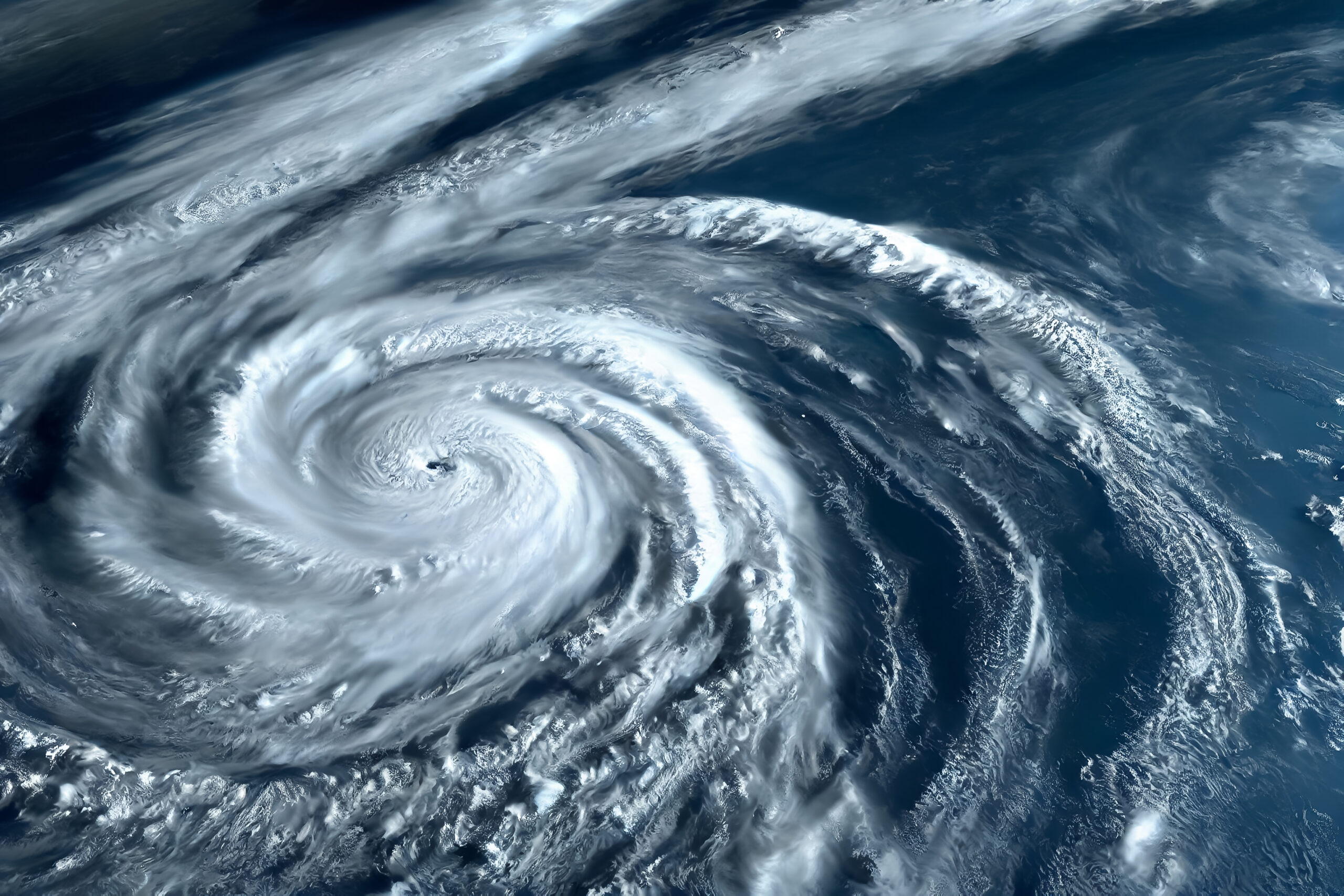

1. Understand Local Risks

Louisiana is known for its unique climate and geography, which can pose specific risks such as hurricanes, floods, and termites. Familiarize yourself with these risks and consider additional coverage, like flood insurance, which is crucial in many areas. Speak with your insurance agent at Page Insurance to ensure you have the appropriate protection.

2. Review Your Homeowners Insurance

As a new homeowner, it’s vital to review your homeowners insurance policy carefully. Make sure you understand what is covered and what isn’t, including personal property, liability, and dwelling coverage. Don’t hesitate to ask questions—our team is here to help you find the right policy for your needs.

3. Maintain Your Property

Regular maintenance is key to preserving your home’s value. Create a seasonal maintenance checklist that includes tasks like checking your roof, cleaning gutters, and servicing your HVAC system. A well-maintained home is not only more enjoyable to live in but can also lower your insurance premiums.

4. Get to Know Your Neighbors

Building relationships with your neighbors can enhance your sense of community and provide a support network. They can be invaluable sources of information about local services, safety tips, and community events. Plus, being part of a community can enhance your home’s overall value.

5. Familiarize Yourself with Local Services

Knowing where to find essential services like emergency contacts, utility providers, and healthcare facilities is important. Keep a list of these numbers handy for quick access in case of emergencies. Additionally, getting acquainted with local government services can help you stay informed about community resources.

6. Invest in Home Security

Enhancing your home’s security is vital for peace of mind. Consider installing a security system, outdoor lighting, and sturdy locks. Not only does this protect your home, but many insurance companies offer discounts for homes with security features, which can save you money in the long run.

7. Stay Informed About Homeowner Resources

Louisiana offers various resources and organizations for homeowners, including local workshops on home maintenance, energy efficiency, and insurance education. Take advantage of these opportunities to enhance your knowledge and connect with other homeowners.

8. Plan for Future Changes

Your needs may evolve over time, whether due to family growth, job changes, or lifestyle shifts. Keep this in mind as you plan your finances and insurance coverage. Regularly reassess your policy to ensure it reflects your current situation.

Becoming a homeowner is a journey filled with learning and growth. At Page Insurance, we’re here to support you every step of the way. If you have questions about your insurance options or need assistance in tailoring your coverage, don’t hesitate to reach out. Here’s to new beginnings in your Louisiana home!

Read More Blog Posts:

The Importance of Regularly Reviewing Your Homeowners Insurance Policy

The Importance of Regularly Reviewing Your Homeowners Insurance Policy Your home is one of your most valuable assets, and having [...]

Hurricane Season Starts June 1: Is Your Insurance Ready?

Hurricane Season Starts June 1: Is Your Insurance Ready? In Louisiana, we know that hurricane season isn’t just [...]

Boating Season is Here! How to Stay Safe and Prepared

Boating Season is Here! How to Stay Safe and Prepared There’s nothing quite like hitting the water on [...]

Contact Us For Your Insurance Needs

Contact Us For Your Insurance Needs

Ready to get started? Reach out to us today for a free quote or a thorough insurance review. Let us show you the difference that experience, knowledge, and personalized service can make in your insurance coverage.

Charles A. Page & Sons Insurance Agency Inc. is here to provide you with peace of mind, ensuring that you, your business, and your loved ones are protected. Your satisfaction and security are our top priorities.

Stay In Touch